By: Sharna Johnson

There are many factors involved in selecting a college – programs of study, location, funding, cost and housing options to name a few – but the U.S. Department of Education is promoting an additional tool to help students and families make informed decisions, specifically aimed at shining the light on what happens after college.

College Scorecard data is intended to provide students insight beyond traditional college vitals such as size, average cost and graduation rates, according to a fact sheet provided by the Education Department, which redesigned College Scorecards in 2015 under the direction of the Obama administration.

Expanded information on how students fare financially after leaving college is included in the newest College Scorecards, released in September.

“To address the lack of information about college quality and costs, the Administration has created a new College Scorecard to provide reliable and unbiased information about college performance. Armed with this accessible and accurate information, students and their families will be able to make more informed decisions and better understand the consequences and tradeoffs of their choices,” A January technical paper produced by the administration states.

Presenting a digital “scorecard” for each college, the interactive database gives information on school size, graduation and retention rates, student body characteristics including socioeconomic data, academic programs, and SAT/ACT scores.

Scorecards also alert users when a school is in the hot seat, for example, the scorecard for Eastern Oklahoma State College displays a red flag indicating the school is under monitoring by the Education Department due to financial or federal compliance issues.

Gaining the most attention, however, is school-specific data on income levels of college versus high school graduates as well the average salaries of graduates, average debt rates and typical monthly loan payments – in essence, giving perspective on how attending a particular school might influence earning potential and ability to repay college debts after graduation.

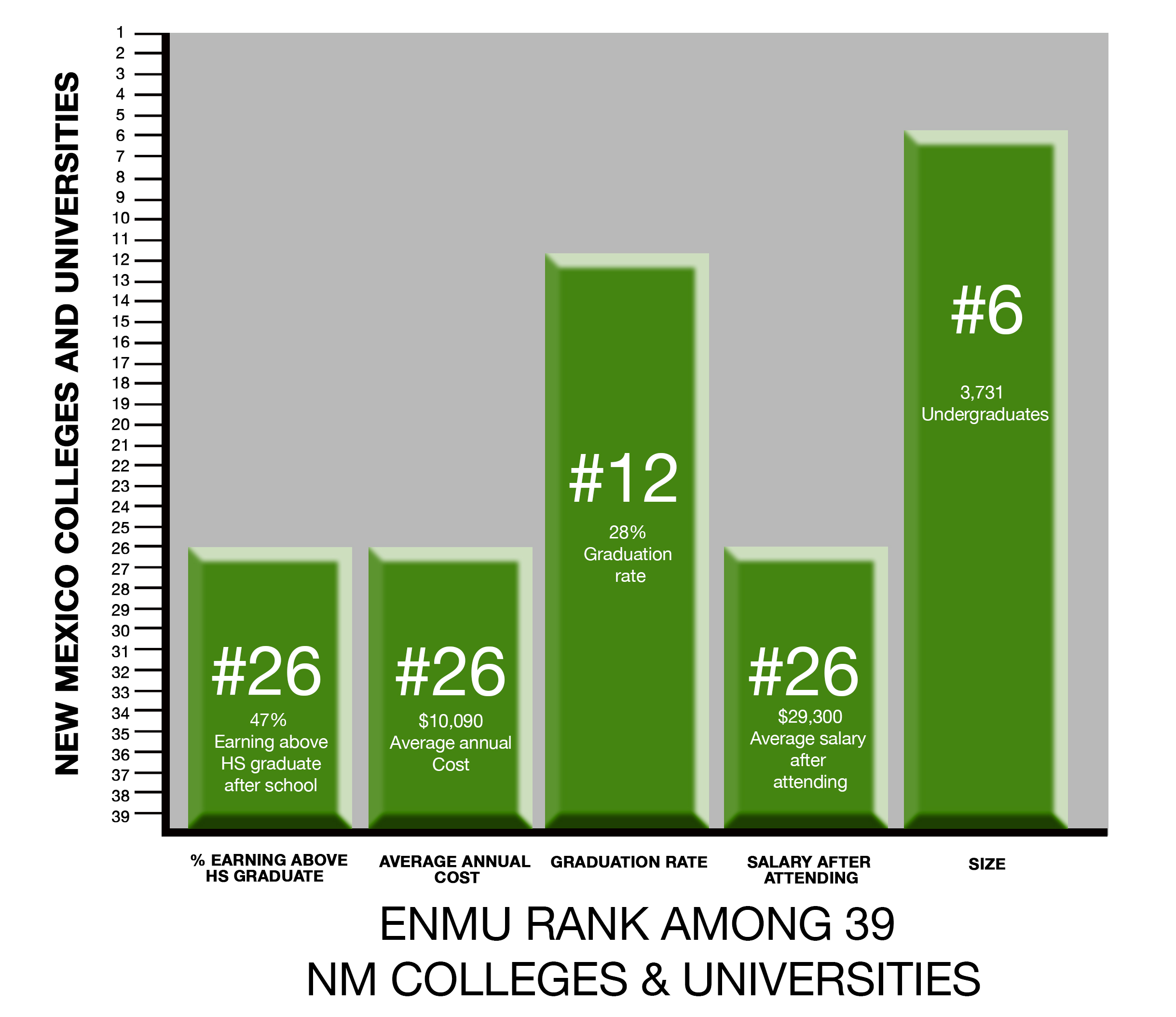

For instance, ranked the sixth-largest of 39 colleges in New Mexico, graduates of Eastern New Mexico University, Portales, on average earn $ 29,300, and 53 percent earn the same or less than those with only a high school diploma, according to College Scorecard data.

However the data also shows ENMU students pay some of the lowest education costs in the state, ranking 26 of 39, with an average annual expense of $10,090. Additionally, only 33 percent of students use student loans, leaving school with an average undergraduate debt of $15,750 and a typical monthly loan payment of $162.

Comparatively, at University of New Mexico, Albuquerque, the largest 4-year school in the state, loan use is nearly 10 percent higher, with undergraduates averaging $19,576 in take-away debt, average earnings of $34,900, and 44 percent making the same or less than those with high school diplomas, College Scorecard data shows.

Essentially, though vastly different in program diversity, location and size – UNM has 20,261 undergraduate students; ENMU has 3,731 – when debt versus salary is accounted for, the financial outcomes for graduates of either school are strikingly similar.

College Scorecards have received criticism for not painting an entirely realistic picture.

In a February 2016 analysis titled “Scoring the College Scorecard” the Center for American Progress made numerous critiques and suggestions for improving scorecards after the Education Department released its first batch of revised data.

Among concerns raised in the report was scorecards are based upon records of students receiving federal financial aid and excludes information of students funded through private means due to a congressional ban preventing the Education Department from collecting data of non-financial aid recipients. As a result, scorecard data is representative of only a percentage of students.

Additionally, the CAP recommended the averages presented should be more specific – broken down by program, completion status, the year students leave school and including graduate student results – while acknowledging the suppression of non-federal aid data.

Though the digital interface is simple to use, considering College Scorecard data does require users to think a little deeper and apply perspective when judging school results, as CAP’s recommendations imply.

Earning data is drawn from 2013 income tax records – on the cusp of being three-years-old at the time of release – and does not address career-specific salary projections.

For example, in 2015 an over-25 high school graduate averaged $35,356 annually, while an individual possessing a bachelor’s degree earned an average salary of $59,124, according to US Labor Department statistics.

And Labor Depart figures go even further to define career-specific financial outcomes – an individual in computer and mathematical occupations was projected to earn a median $81,430 in 2015, compared to $19,580 for food preparation and serving related occupations.

Admittedly, College Scorecard data is expressed in averages and does not necessarily speak to individual student success, the Obama administration acknowledged in its report.

Where its true success lies, is in demonstrating how federal data can be applied as a measurement of college outcomes, an area not thoroughly explored prior to the revamping of scorecards.

“While most of these data do not necessarily reflect how a specific individual’s outcome would change were he or she to attend a particular college, this report offers exploratory analyses of how federal data may be used to measure an institution’s impact on a subset of performance measures,” the report said.

College Scorecard data holds merit for students in a variety of ways, some argue.

In a January “Treasury Notes” blog article, the US Treasury Department released conclusions about the validity of College Scorecard data based on an analysis of a second, 2017 study of college outcome data titled, “Mobility Report Cards: The Role of Colleges in Intergenerational Mobility in the U.S.”.

The MRC study not only found the scorecard data to be reliable as a predictor of how students perform after attending a specific school, it also provides valuable insight into how students from varied socioeconomic backgrounds can predict outcomes.

“The analysis behind the Scorecard suggested not only that there are large differences across institutions in their economic outcomes, but that these differences are relevant to would-be students.

For instance, the evidence in the Scorecard showed that when a low-income student goes to a school with a high completion rates and good post-college earnings, she is likely to do as well as anyone else there,” wrote Adam Looney, the tax analysis deputy assistant secretary for the US Treasury Department.

Given the wide range of data students encounter when trying to predict post-college success, College Scorecard information becomes a small piece of a larger picture.

While the performance of a particular school may influence a student’s success after college, it is more likely the student’s career choices; financial decisions and academic investment and performance will determine individual outcome.

In considering scorecard data, students and families have an advantage over previous generations in the sense that they can be warned of problems, evaluate costs, typical debt loads, campus size, socioeconomic advantages or disadvantages, average peer standing and performance and average post-college economic predictions.

Just as each student is unique, their experience will be too, however, and information has to be placed in perspective with things such as what a student’s career goals are, whether they plan to pursue higher degrees, where they want to live after school, what their life-goals are and how much income will be needed to meet those goals while repaying any student debts incurred along the way.

Students owe it to themselves to plan and research their futures as realistically – combining data and goals – as they can, while making an investment of time and effort, because ultimately post-college success will be determined through a combination of informed decision making and hard work.

On the web:

College Scorecards: collegescorecard.ed.gov

US Labor Department Employment Projections: www.bls.gov/emp/ep_table_001.htm